The Zions Bank’s online banking experience is secure and easy to use, which allows you to take care of your banking needs from most places in the world. From looking to bank, borrow, invest, or learn, Zions’ online banking platform has a number of features under each of its categories. This guide will walk you step-by-step through Zions’ log in process and the information you will need to take advantage of a variety of Zions’ banking services.

Zions Online Banking Login Portal – Step-By-Step Guide

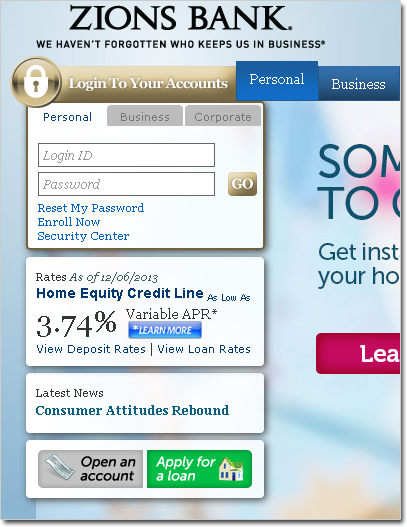

In order to sign in to Zions’ banking portal, you need at least a username and password. There are three account types available when banking with Zions. Each has the same basic log in page.

- Open a compatible web browser and head to the Zions online banking login page.

- Enter your information into the fields Login ID and Password

- Select the check-box for your information to auto-populate the next time you log in.

Zions Mobile Banking Login Portal – Step-By-Step Guide

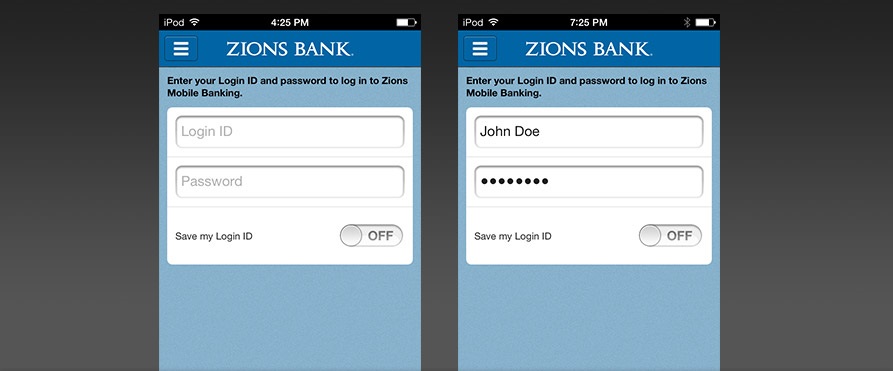

The process of logging in to Zions Bank’s mobile app is almost the same as logging in online.

- Download the Zions mobile banking app from your smartphone’s designated app store.

- Launch the app and reach the log in home screen

- Enter a user ID and password, or use a fingerprint ID to log into your accounts

Zions Personal Banking on Mobile

This login page simply asks for your username and password. Additionally, you are able to save your user ID for the next time you decide to log-in.

There is also an about page link to direct you to further instruction guides. And there is a location feature to help you find available Zions Bank branches and ATMs near you.

What Makes Digital Banking At Zions Bank Unique

Zions online banking helps customers take control of their finances whether those funds are used for bills, transfers, or online deposits. There are a variety of digital management tools available to the account holder like on-the-go check deposits and transfers.

There are also a number of promotional plans offered by the bank such as ticket presales to Broadway shows. Some of the other promotional deals that come with Zions online banking experience, include events like Utah’s Shakespeare Festival and upgrades like Megaplex Theater upgrades.

The Utah-headquartered bank offers its banking services online as well as on mobile. There’s a lot to explore online with Zions Bank, but its mobile app offers competitive on-the-go personal banking solutions.

What Makes Mobile Services At Zions Bank Unique

The mobile option allows customers to login from almost anywhere on the go. The app is compatible with Apple’s iOS 8.4 versions and higher as well as with Android’s OS 4.1 and higher.

There are more than a couple of features that make it convenient to use Zions Bank’s mobile app. A popular fingerprint ID and then on-the-go payment schemes, investment solutions, and check deposits make the mobile app a respectable feature of this bank’s digital services.

What Are Zions Bank’s Additional Features And How Do They Work?

Some of the additional features that come with banking with Zions Bank includes 24-hour access to your finances, online payment plans, account alter options, and a variety of balance transfer options.

Additionally, it is easy to schedule timed payments and add new payee information. These features are also available through the mobile bill pay option when on-the-go. There are no fees applied to check deposits going through your phone too.

This Utah bank offers a variety of checking and savings accounts to choose from for your personal and professional banking needs. Each account comes with a fee structure, which includes a minimum deposit requirement, a maintenance fee, and a paper statement charge.

Pricing And Other Costs Of Zions Bank’s Checking Account Options

Zions Bank needs a minimum deposit of $50 to open a checking account. There are three types of checking accounts – Anytime Checking, Anytime Interest Checking, and Premium Interest Checking.

Anytime Checking

This account only takes a minimum balance of $50 to start. There is no monthly maintenance fee. The paper statement service costs $3 with the Anytime account, but can be waived by moving to Zions’ digital service.

Anytime Interest Checking

This interest-bearing checking account also takes a minimum balance of $50 to start. Plus, this account charges a monthly maintenance fee of $10 unless the account holder can maintain a minimum daily balance of $1500. The fee can also be waived if the account holder has a combined deposit and consumer loan balance of $10000. Getting paper statements costs $3 here too.

Premium Interest Checking

This account is the highest grossing, but only takes a minimum balance of $50. However, the monthly maintenance fee is $20 and can only be waived if the account holder maintains a deposit balance of at least $10000. This account does not charge for paper statements.

Pricing And Other Costs Of Zions Bank’s Savings Account Options

Zions Bank has three main savings account options – a standard savings option, Money Market Savers, and Young Savers Account.

Savings Account

The minimum balance needed to open a standard savings account is $50. There is no minimum balance needed to earn interest on the principal amount though. The interest earned on the account is compounded daily and paid monthly.

On top of it all, there is a monthly maintenance fee of $3. This monthly fee can be waived by maintaining a minimum daily balance of $200.

Young Savers Account

This account takes a minimum deposit of $5 to open. As given in the name of these accounts, the target user base is mostly young adults. Given many students and early career starters hold accounts, there is no minimum balance needed to start earning interest on your principal amount. Interest is paid on a monthly basis after accounting for daily compounding on the principal.

The Young Savers Account does not take a monthly maintenance fee. It is one of Zions Bank’s most low-cost accounts, easy to start and maintain in the long term. The account is a great way for young savers to learn about banking and the associated financial tools.

Money Market Savers Account

The most expensive option requires a minimum deposit of $500. Additionally, the account needs a minimum balance of $1000 to start accruing interest. Interest is paid monthly at a variable rate on a principal that is compounded daily.

The Money Market Savers Account does not take a monthly fee. It is another of Zions Bank’s account offerings that have low-costs of entry and are easy to maintain.

Public Perception

Most of the public attention that Zions Bank has been getting has been focused on the wellbeing and success of employees.

The bank has a modest following, but operates in 10 Western and Southwestern states in the U.S. including Arizona, California, and Colorado.

Here Is What We Think

There are a number of reasons why Zions Bank stands out among its competitors.

Zions Bank Login Options

Zions online banking login is simple with prompts for a username and password. Additionally, the links to bank geolocations and help guides on the login page are useful add-ons.

There are other stand-out features to Zions banking experience too, like the fingerprint logins. This login is only available on smartphone devices.

Zions Bank Offers Competitive Rates

The Utah bank offers some of the more competitive interest rates and low to no annual fees on its financial products. For example, Zions Bank offers a line of credit cards that offer competitive rates, sign-on incentives, and no annual fee. These cards, AmaZing Rewards, AmaZing Rate and AmaZing Cash offer you an advantage when it comes to company spending. These credit cards offer either a $1000 bonus or credit of 100,000 rewards points when you spend $7,500 within 90 days from receiving your card.

Powerful Balance Transfer Options

Zions Bank offers a number of ways to transfer funds whether it is to pay bills or pay a friend.

The Popmoney feature just needs an e-mail address or a mobile phone number in order to complete a transfer. While this feature may not be a standout offering at Chase or Bank of America, it does offer a competitive edge to a lesser known brand of banking like Zions Bank.

Promotional Offers

From credit card offers with competitive rates to Broadway tickets on discount rates, the Zions Bank seemingly puts more attention on customer service than other banking names.

These promotional offers don’t always lead to higher earnings, but they do show that the bank values you as a customer and your business.

Focus on Business Banking

Zions online banking options focus on the individual needs as well as the business needs of account holders. There are at least three different types of account setups, including personal, business, and wealth.

For example, there are options to upgrade checking and savings accounts to interest-bearing accounts. And there are a variety of options when it comes to interest rates. Again, Zions Bank offers some competitive rates compared to the industry standard when it comes to interest-earning checking and savings accounts.

Financial products like credit cards are competitive among the overall banking sector’s options too.

Final Word On Zions Online Banking

Zions banking experience is one of the easiest to use. Many of the features cater to individual as well as business needs, so it is a versatile financial institution for its size and support. With many competitive financial products at lower rates and fees, it is a good time to start banking with Zions Bank.

Leave a Reply